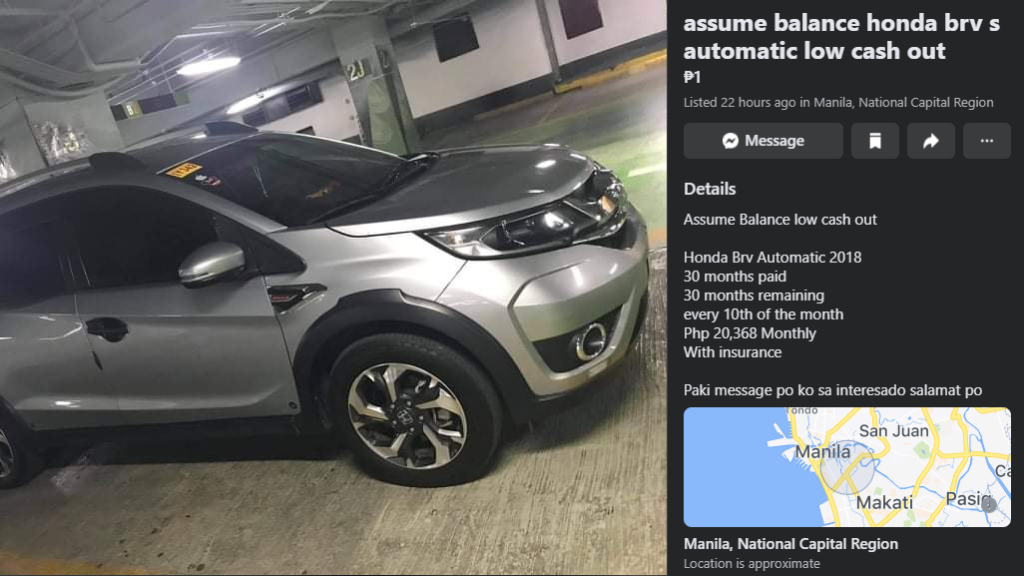

The idea of buying a used car that’s still being paid for by the original owner isn’t new. “Assume balance” or “pasalo” sales have been around since, well, car loans have been around, but it’s become more common because of the pandemic and the economic downturn that came with it. And since our economy has been taking a beating lately, banks and other financial institutions have clamped down on car loans because of the higher default risk in the current economic climate. One way to get a car during these times is to buy an “assume balance” vehicle, but it begs the question: is it safe?

The short answer is yes, if everything is above board and the bank agrees with the sale. The “assume balance” or “pasalo”, sale isn’t illegal per se. It is actually a win-win scenario for all the parties involved; the creditor gets paid, the seller doesn’t default, and the buyer gets an instant loan plus discount. Again, we have to emphasize that it’s safe and legal if the bank agrees with the sale.

The problem with this kind of set-up lies within the bank. More often than not, a loan agreement from the bank contains a restriction that the loan shall not be assigned to a third party without the express consent of the bank. If you’re a buyer, that means you must therefore scrutinize the original loan agreement first before committing to it. This applies to the sale of both real properties and vehicles mid-term.

For the seller, any restriction in the promissory note with chattel mortgage must be considered, and the written consent of the bank to any assume-balance setup should be obtained. Otherwise, the original buyer may be deemed in breach of the obligation typically stated in the Chattel Mortgage that the borrower shall not remove the mortgaged property from his possession or the stated address without the prior written consent of the mortgagee/bank.

More importantly, Article 319 of the Revised Penal Code, under the title “Chattel Mortgage”, says that the mortgagor is liable if they sell or pledge personal property already pledged, or any part thereof, under the terms of the Chattel Mortgage Law, without the consent of the mortgagee written on the back of the mortgage and noted on the record thereof in the office of the register of deeds of the province where such property is located.

Take note you can only legally assume the balance of a vehicle or property under two requirements: first, the loan contract must not prohibit the assume-balance setup; second, you need to acquire the consent of the bank or mortgagor and have it noted in the respective registry of deeds. Without complying with the said requirements, the seller cannot sue or file for action in case there’s a breach or noncompliance. In short, if your bank specifically prohibits an assume balance sale of your vehicle and you do it anyway, you’re pretty much screwed if the buyer doesn’t go through with the payments.

Thereafter, the contract of sale on an assume balance basis is finally free of any legal obstruction. You may now stipulate according to Article 1306 of the New Civil Code, to wit, parties may establish such stipulations, clauses, terms and conditions as they may deem convenient, provided they are not contrary to law, morals, good customs, public order, or public policy. In the instant case, it would no longer be contrary to law once conditions are complied with. Therefore, you may proceed with the contract and sue for damages anytime in case there’s a breach. There’s no more need to worry that the contract is not legally binding by being not in accordance with the law. Ultimately, the assume balance or pasalo set-up on your car or motorcycle is safe and legal.

For the buyer, it goes without saying that you should do your due diligence. Although the sale on assume balance basis is generally convenient and a good idea, it is not always the case. Of course, you have to consider things like depreciation, actual condition, warranty, and the person you’re dealing with. Also take note that the incidence of scams in this kind of sale has ballooned because of the pandemic. Don’t get blinded by the good offer. Be very cautious because you are buying a used car, from an unknown individual, and in an unusual way—pasalo.

So, should you still consider a sale on an assume balance basis? Sure, but make sure you comply with all the legalities required. A mere contract of sale will not save you, it will not be binding in the courts of justice if it is against the provisions set forth by the law. Both buyers and sellers will need to do their due diligence before closing the deal as well. As long as you do this, you can guarantee that your assume balance deal will be safe and above board.