Want to avoid paying ATM fees? We got you covered. If you haven’t heard, a number of local banks start implementing their interbank fees today with more banks soon to follow, thanks to a new Acquirer-Based Fee Charging (ABFC) model that the Bangko Sentral ng Pilipinas is now requiring banks to follow. Simply put, this scheme charges non-home bank-issued cards for balance inquiries and withdrawals. There are ways around paying these fees though – here are 5 ways to not pay those pesky fees:

5 Ways To Avoid ATM Fees

- Transact on your home bank

- Use your Bank’s App

- Find your nearest 7-Eleven ATM

- Use A Digital Bank Account

- Use an e-wallet

Transact on your home bank

This is the easiest and most convenient way to avoid ATM fees. Interbank fees are charged to ATM card-holders who are not from your home bank. For example, if a BDO cardholder checks their balance on a BPI ATM, they’ll incur a Php 2 charge on their account. You won’t be charged for withdrawing from other branches of the same bank if that’s what you’re worried about.

Use your Bank’s App

Use your Bank’s App

If you need to check your balance the safest way to do it is from your phone. Most banks have their own digital app and is free to download. You just need to make sure your bank account is enrolled online for you to be able to maximize all the features on your home bank’s app.

Find your nearest 7-Eleven ATM

Find your nearest 7-Eleven ATM

Does your 7-Eleven have an ATM in them? Chances are, that’s a 7-Eleven ATM machine which is good news if your ATM card is part of the Bancnet network, particularly BDO cardholders. If you happen to have an ATM issued by an e-wallet or digital bank, you shouldn’t be charged from withdrawing on a 7-Eleven ATM.

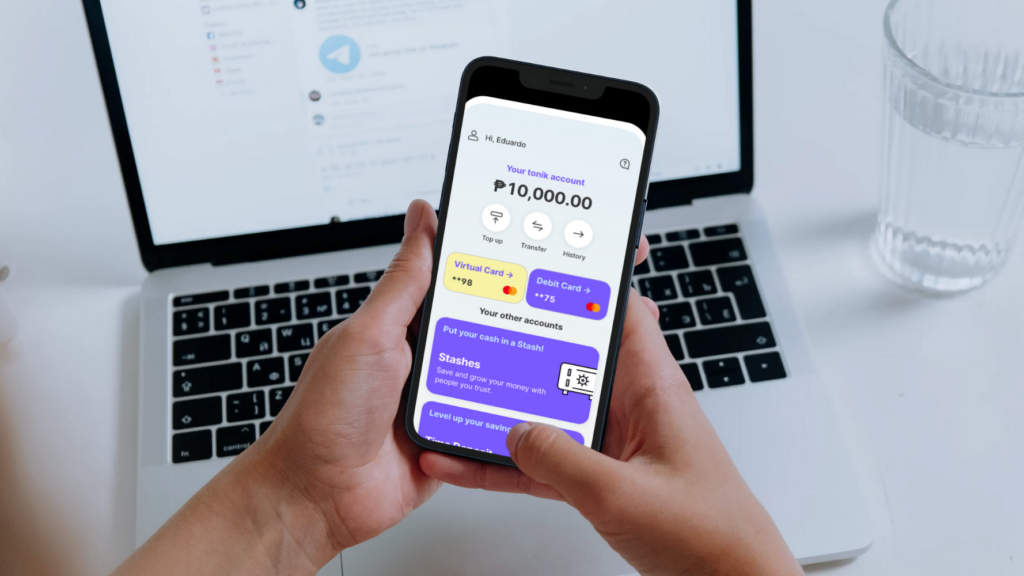

Consider Using A Digital Bank Account

Consider Using A Digital Bank Account

Digital banks usually let you transfer money in and out of your account to physical banks without fees as part of their marketing strategy to draw in more users. It’s not entirely clear if the ATM fees also apply to ATM cards issued by digital-bank apps however we do know that EastWest’s digital bank KOMO, grants account holders 4 free withdrawals per month until further notice, while Tonik refunds you for ATM transaction fees you incur.

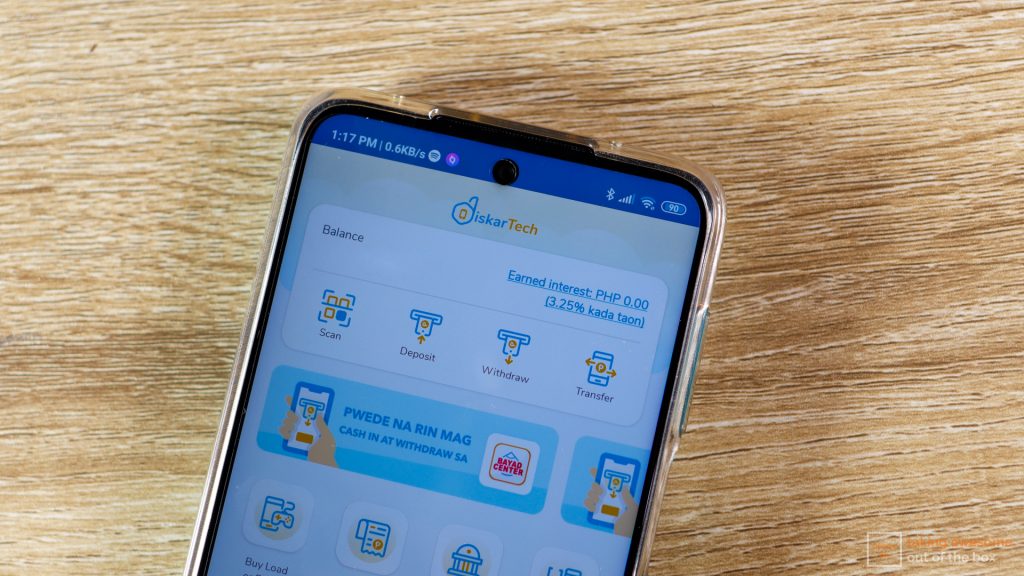

Use an e-wallet

Use an e-wallet

If your home bank ATM is nowhere in sight, perhaps you can transfer that fund to your e-wallet and cash out from there. Most e-wallets lets you withdraw funds for free. DiskarTech users can make cardless withdraws from RCBC ATMs. If you’re a Gcash user, here’s how you can cash out.

Have more tips to share? Let us know your tips on how you withdraw without paying ATM fees. Not sure of your bank’s ATM interbank rates? Check out the rates here.