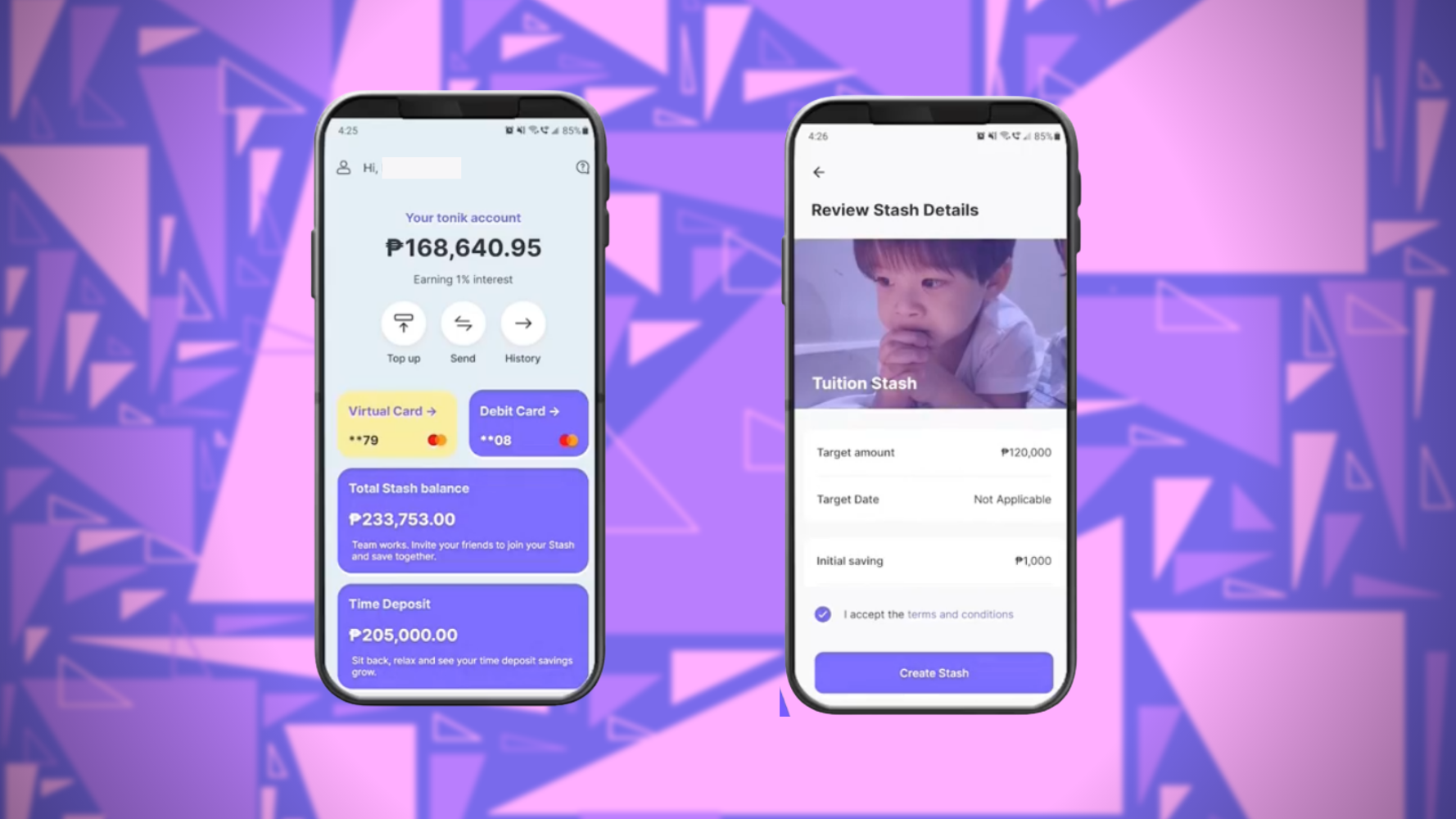

It has been a year since Tonik offered its services in the Philippines as a next-generation neo bank that offers competitive interest rates (as high as 6% per annum for time deposits) and convenient ways of opening a digital bank account. Since then, it has secured over Php 5 billion in deposits in a span of 8 months. As part of celebrating its first anniversary in the Philippines, Tonik is set to expand its offerings that include purchasing cryptocurrency through its app.

“The Philippines is one of the biggest markets in demand of crypto and lending services in the world, and we are laser-focused on making these available soon in our app,” Tonik Founder and CEO Greg Krasnov said.

Aside from its plans to add cryptocurrency to its app, Tonik is also eyeing new loans of up to Php 2.5 million for its customers as part of its efforts to further accelerate financial inclusion in the Philippines. Tonik assures that more accessible, simplified and customer-centric banking products will be available to more Filipinos in many more years to come,” Krasnov adds.

Tonik is confident with its expansion plans as it recently bagged a Series B funding of $131 million from Mizuho Bank, making it one of the biggest Series B fundings in the Philippines to date.

Tonik is one of the six digital banks that was given a license to operate in the Philippines by the Banko Sentral ng Pilipinas.