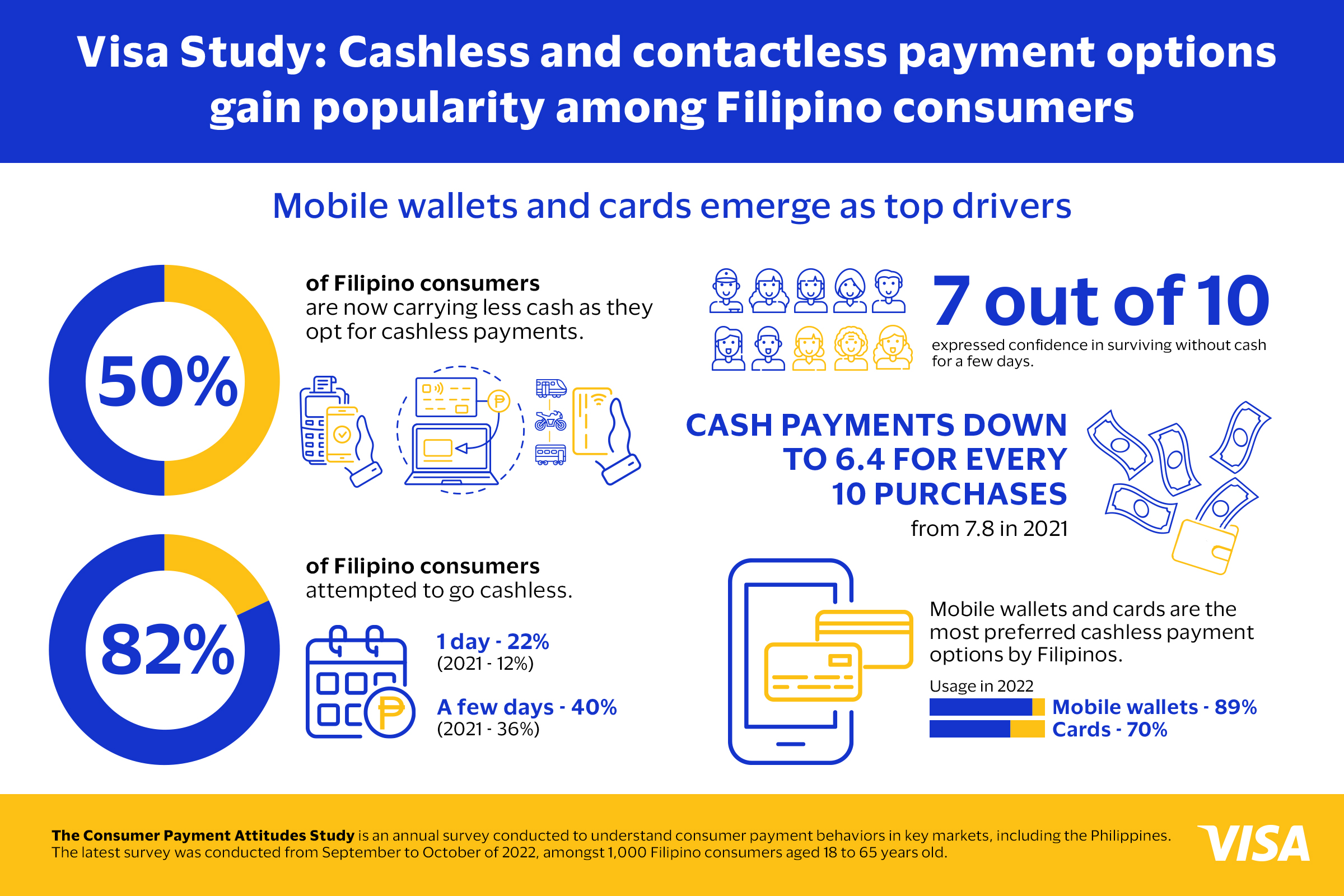

One of the major effects of the COVID-19 pandemic in 2020 is the rise of contactless payments and less dependency on cash in doing transactions. That trend continues to grow further, as Visa’s 2023 Consumer Payment Attitudes Study reveals that around 50% of Filipinos are carrying less cash in 2022. Further findings also reveal that 82% of Filipinos attempted to go cashless in 2022, showing the country’s willingness to further adopt contactless payments and be less dependent on cash.

“The increasing adoption of cashless and contactless payment methods is a testament to the growing preference among Filipinos for safe and convenient transactions,” Visa Philippines and Guam Country Manager Jeff Navarro said. “As consumers realize the benefits of cashless options such as mobile wallets and cards, we are witnessing a progressive shift towards a cash-lite society in the Philippines.”

Online, in-app payments most popular for e-wallets

Diving through the study made by Visa, around 68% of Filipinos utilize online and in-app payments for their e-wallets, while 53% use QR code payments. For card payments, 50% are done for online transactions while contactless in-store payments (tap-to-pay) have grown significantly at 37% (vs 27% in 2021) as credit card companies update their cards to have NFC chips and depend less on magnetic strips.

QR payments appear to have the biggest growth by 17% compared to 2021 as e-wallet apps like Maya and GCash have started to adopt the QR Ph standard for QR payments. With the adoption of a more universal QR standard, interest for QR payments has increased from 67% in 2021 to 93% in 2022.

“We anticipate that cashless and contactless payment methods will continue to gain prevalence in terms of awareness, interest, and usage,” Navarro adds.

Pros and cons of contactless payments

During their presscon at Makati, Navarro explained that among the main drivers for Filipinos to use contactless payments include the ease of use and better security, with the latter being significant as this meant that Filipinos don’t need to bring a lot of cash to settle their transactions. Those using mobile wallets also cite the rewards they get from paying using their e-wallet–one of the best examples of this is Maya, which gives perks like cashback and increased interest rates for users’ savings accounts when using their platform for various transactions.

With all the perks contactless payments bring to the table, there are a few cons to it. Chief among these includes dealing with unauthorized transactions and flagging fraudulent transfers. This was aired out in the recent issue involving GCash, where the unauthorized transactions were due to phishing done by online gambling sites.

More contactless payment methods?

As with other methods of contactless payments, Navarro said that while some establishments in the Philipines allow you to pay using your phone and smart devices, he explained that there’s a need for big companies like Google and Apple to make Apple Wallet and Google Pay available in the Philippines. As of this writing, Apple Wallet and Google Pay are available to users with Philippines-based accounts.