One of the most important things we need to do as Filipinos is to pay our taxes. One of the taxes freelancers or small businesses would pay is Percentage Taxes, which can be done on a monthly or quarterly basis.

There are many ones one can pay taxes, and online services like Maya and BPI eGov has made paying percentage taxes very convenient for everyone. We have used all three methods, and they all prove to be easy to use. Here’s our guide on how to pay taxes online using BPI eGov or Maya.

READ MORE:

–PayMaya Partners with BIR for Hassle-Free Tax Payments

Before we go into detail with the actual payment of taxes, here’s a quick guide on how you can file your Percentage Taxes, which can be done on your Windows computer using BIR’s eBIRForms software.

How to fill up Percentage Tax (2551M/2551Q) form

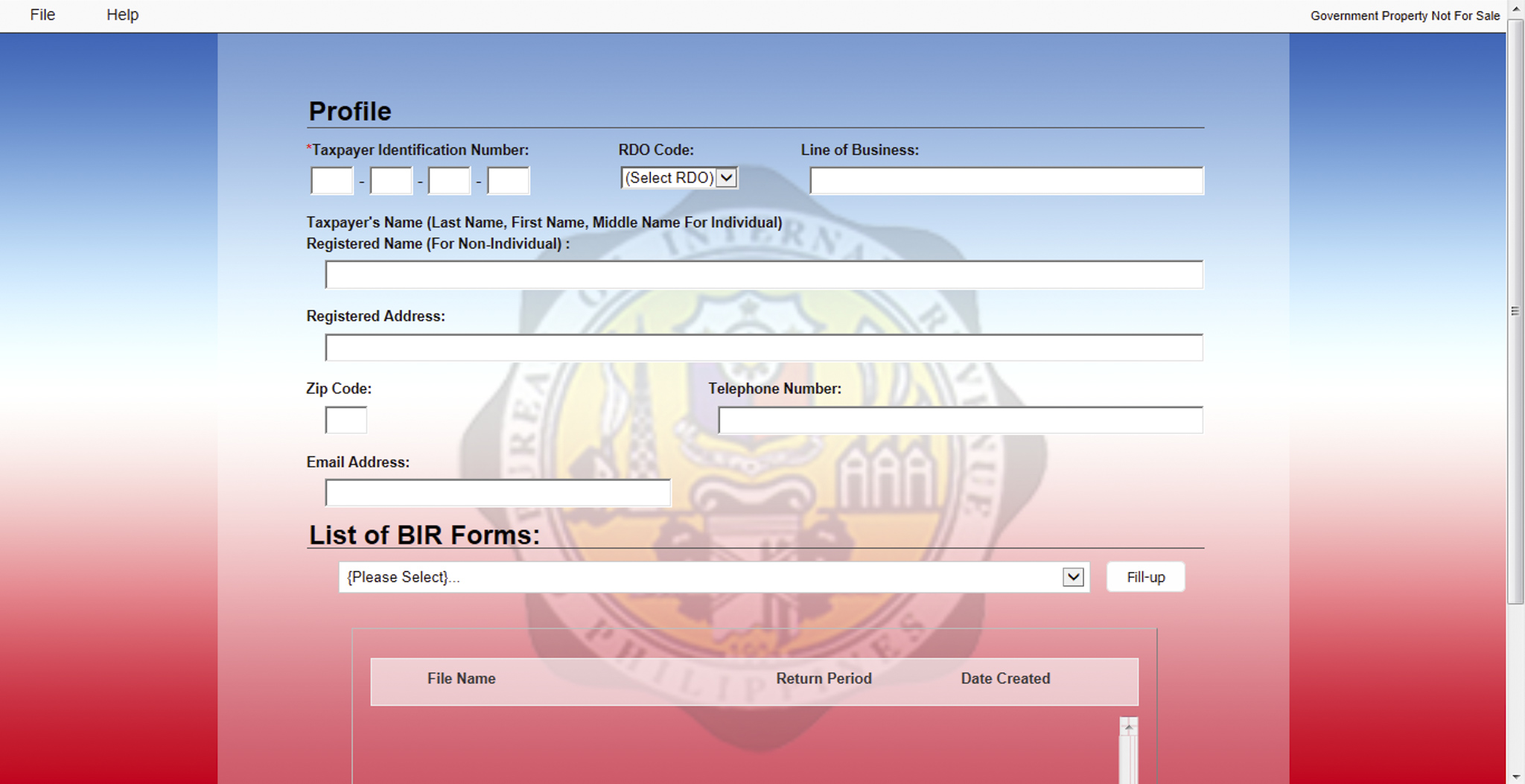

- Download eBIRForms software here. To save time, download BIR’s own software onto your computer to get access to all the forms you will need to file taxes. Do note, however, that only Windows is supported for BIR’s software.

- Fill up your taxpayer’s information (TIN, registered name, address). Make sure to fill up all of your taxpayer’s information accurately. Aside from the usual information, you need to make sure that you input the right RDO (Revenue District Office) as well.

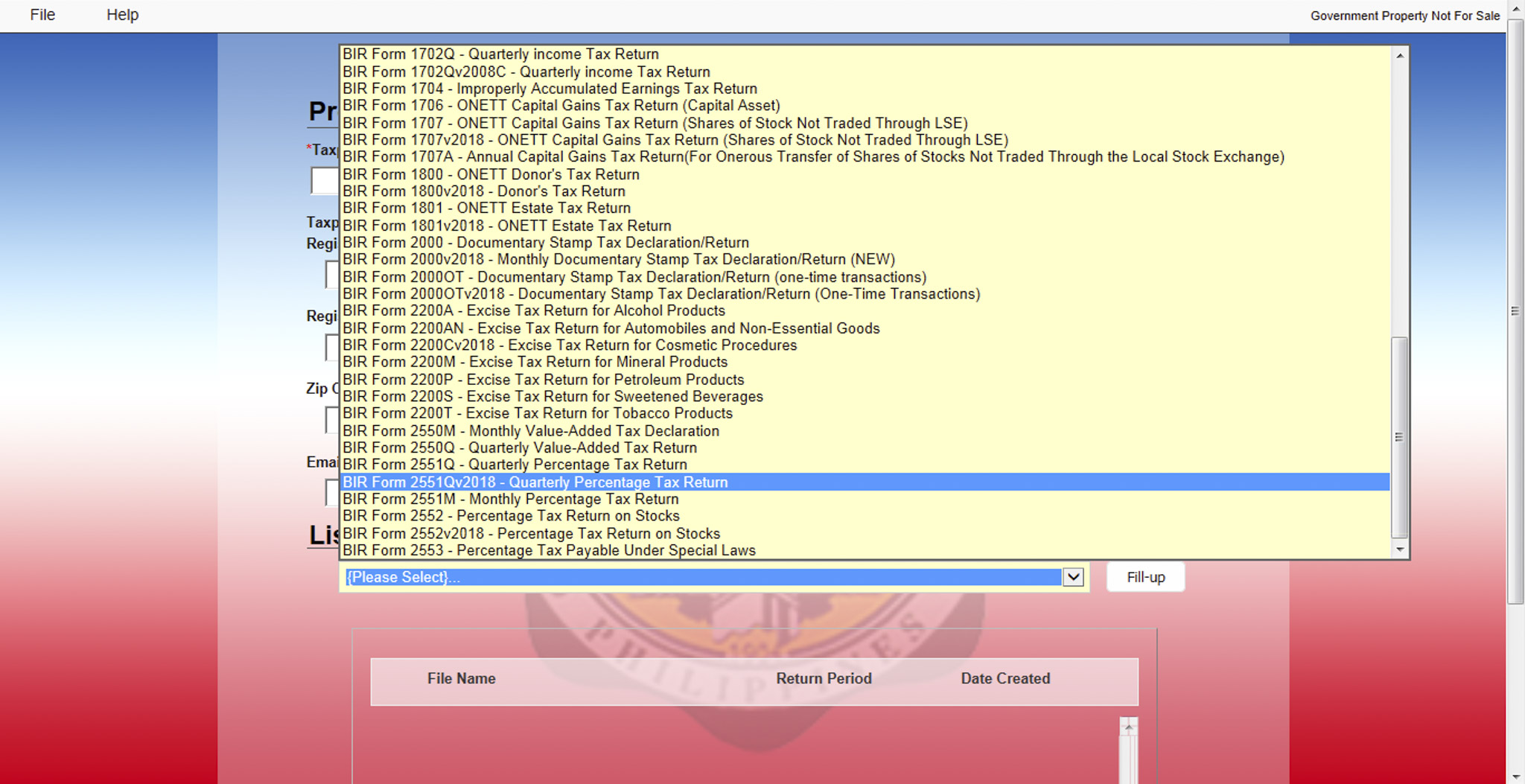

- Choose 2551M (monthly) or 2551Q (quarterly) and fill up form. There are a variety of forms available in BIR’s software. For this tutorial, we focus on form 2551M/Q since that’s what you fill up for submitting your percentage taxes. Make sure to use the 2018 version of form 2551M/Q, as this is the one currently accepted by BIR.

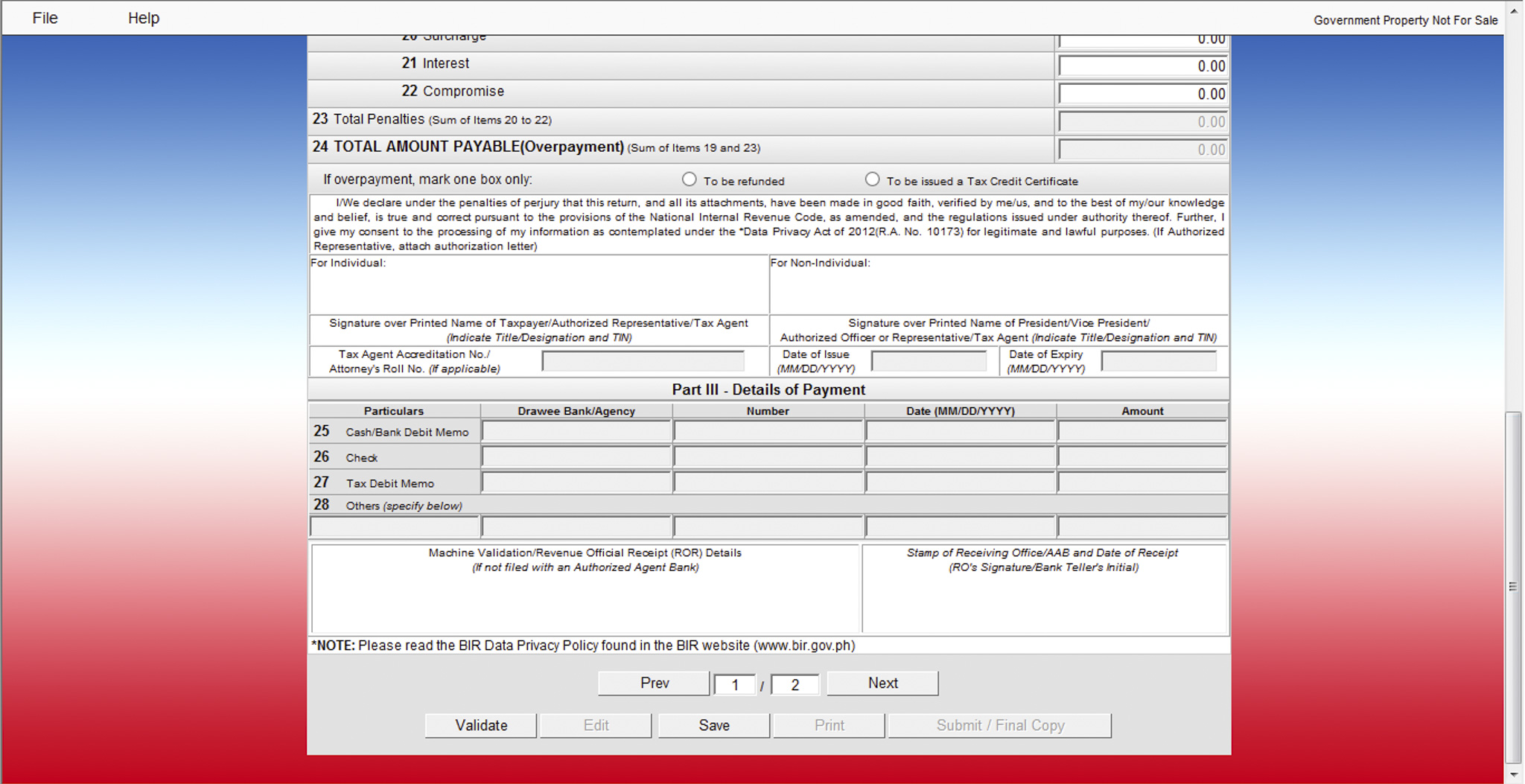

- Make sure to validate all details and submit final copy online. Once you input all of your percentage tax details. click on the validate button to see if you missed out on any part of the form or if you filled up a section incorrectly. Once you’re sure that everything’s right, you can click Submit/Send Final Copy. This button sends your filled-up form online to BIR’s email servers using the email account you registered on BIR’s software.

- Save a copy of your 2551M/2551Q or print a hard copy. After submitting your tax form online, make sure to save a PDF copy or print a hard copy for reference. You’ll need to submit this when you will be filing for annual income taxes.

After submitting your filled-up percentage tax form online, you can proceed to paying for it online as well. For this tutorial, we will focus on the two popular methods: BPI (via their eGov platform) and Maya.

How to Pay Taxes with BPI eGov

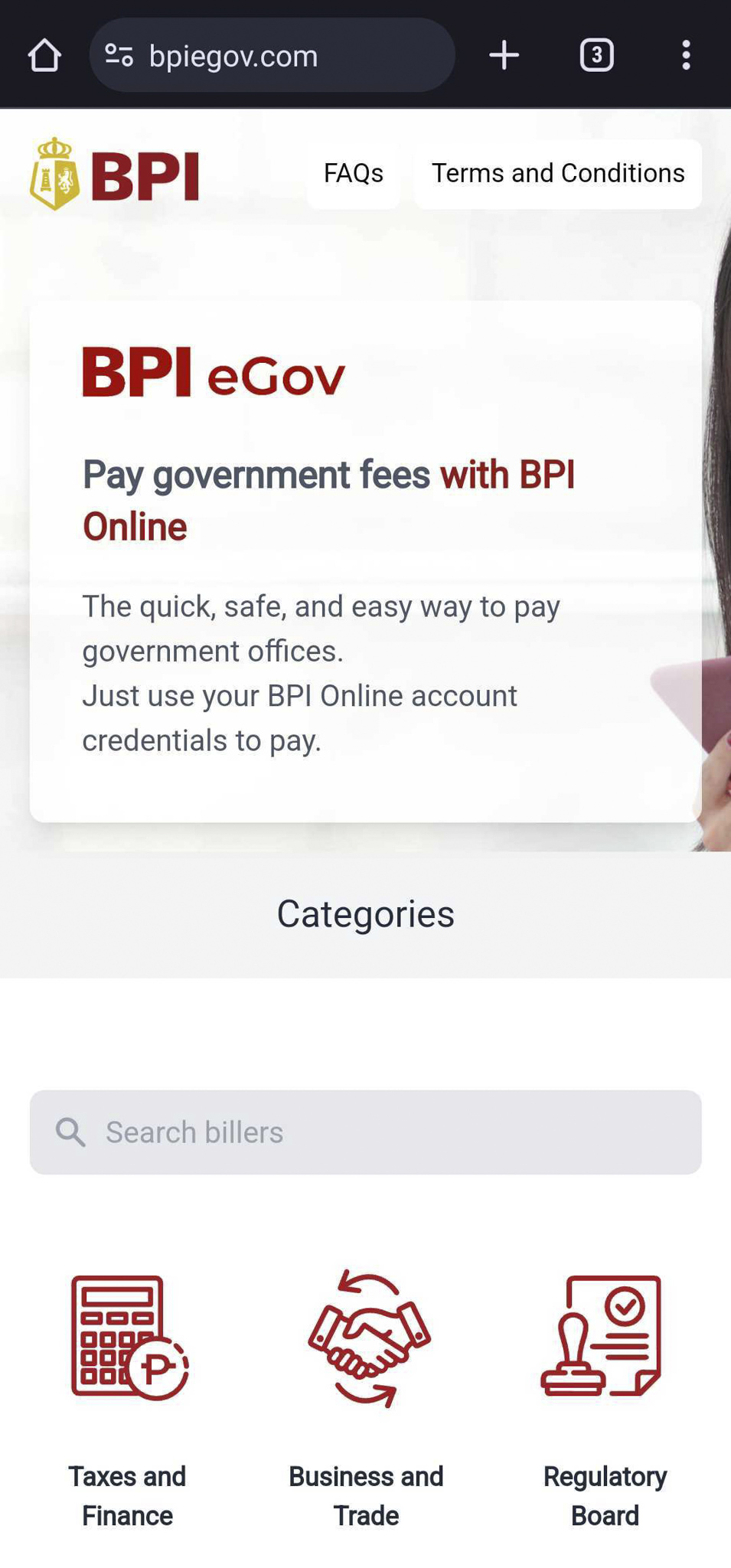

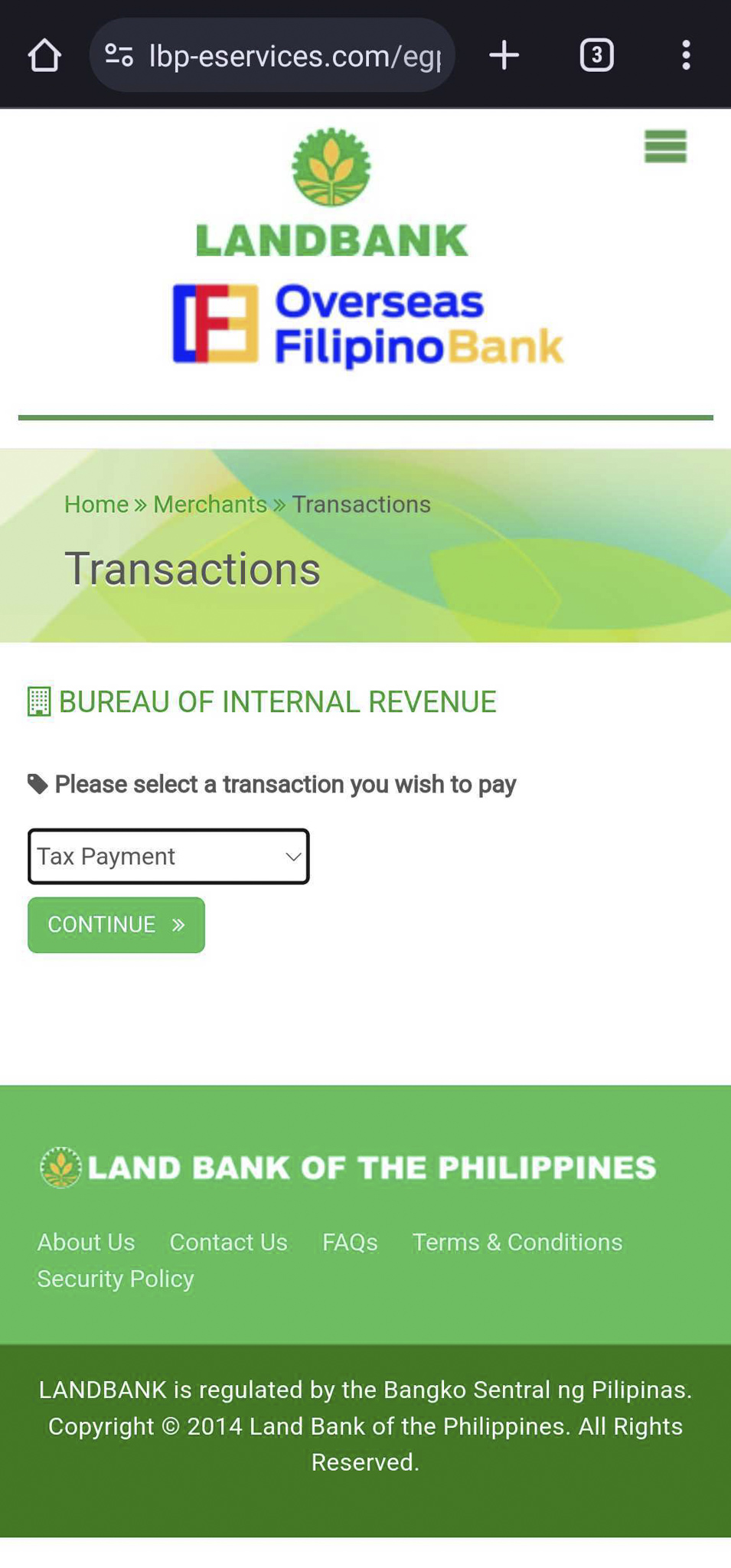

- Go to BPI eGov Website and choose Taxes and Finance. After you click BIR, you will be redirected to Landbank’s BIR payment portal.

- Input your Tax payment details. Make sure to that the information you fill up here is the same one you filled up on the form 2551M/Q you submitted online to BIR.

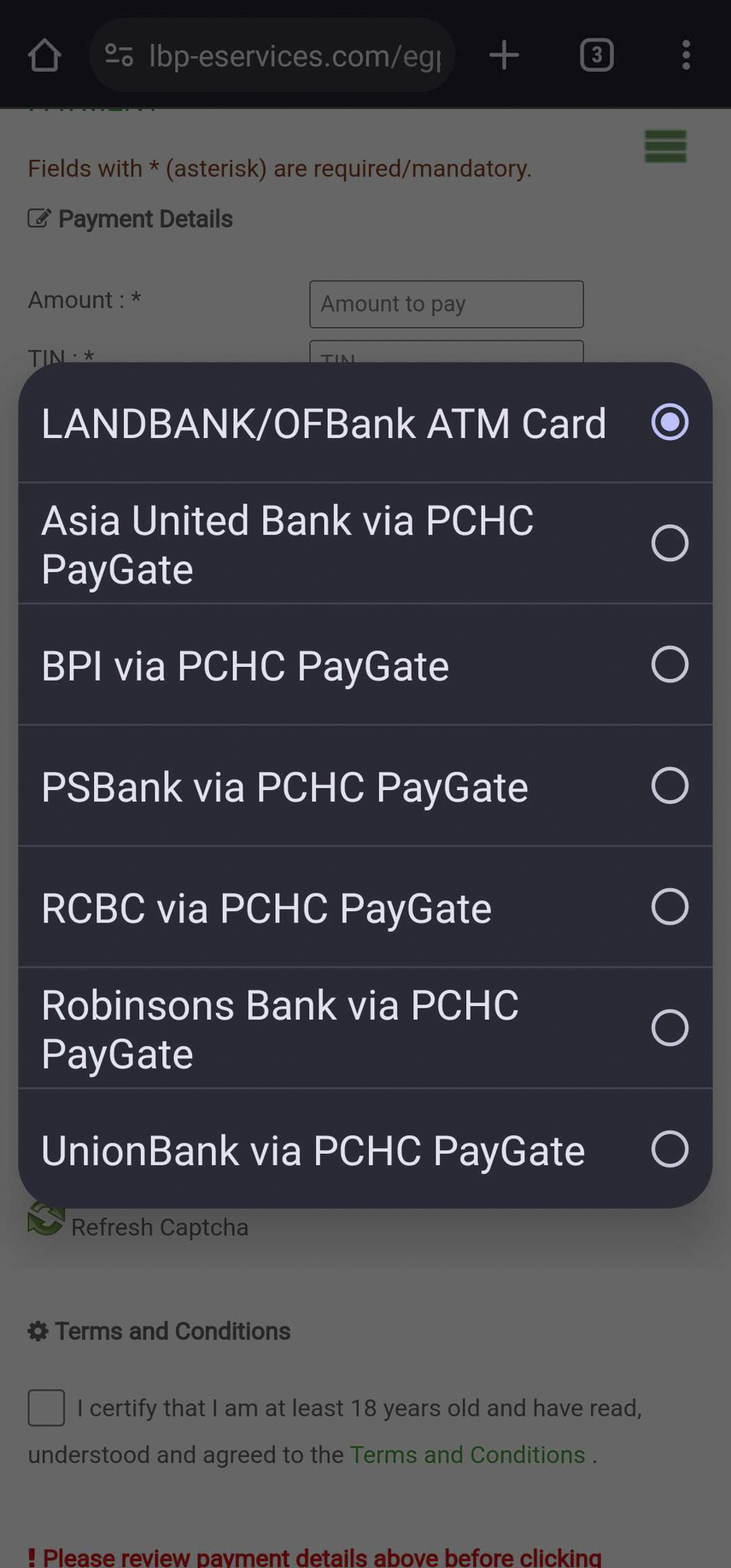

- Click Proceed with Payment to Verify details. From here, the Landbank page will redirect you back to the BPI page to let you log in with your account. Aside from BPI, this method also applies if you have an online banking account with Landbank, Asia United Bank, PSBank, RCBC, Robinsons Bank, and Union Bank.

- Log in with your BPI account (on the next page). From here, you choose which BPI account to use to pay your taxes. Then after selecting that, confirm the transaction using your OTP or Mobile Key (if you have the BPI app on your phone).

- Confirm payment with receipt details. From here, make sure to double check your BPI account (or your Landbank/ Asia United Bank/ PSBank/ RCBC/ Robinsons Bank/ Union Bank) to verify that the transaction went through. You can also check your email for the confirmation as well.

How to Pay Taxes with Maya

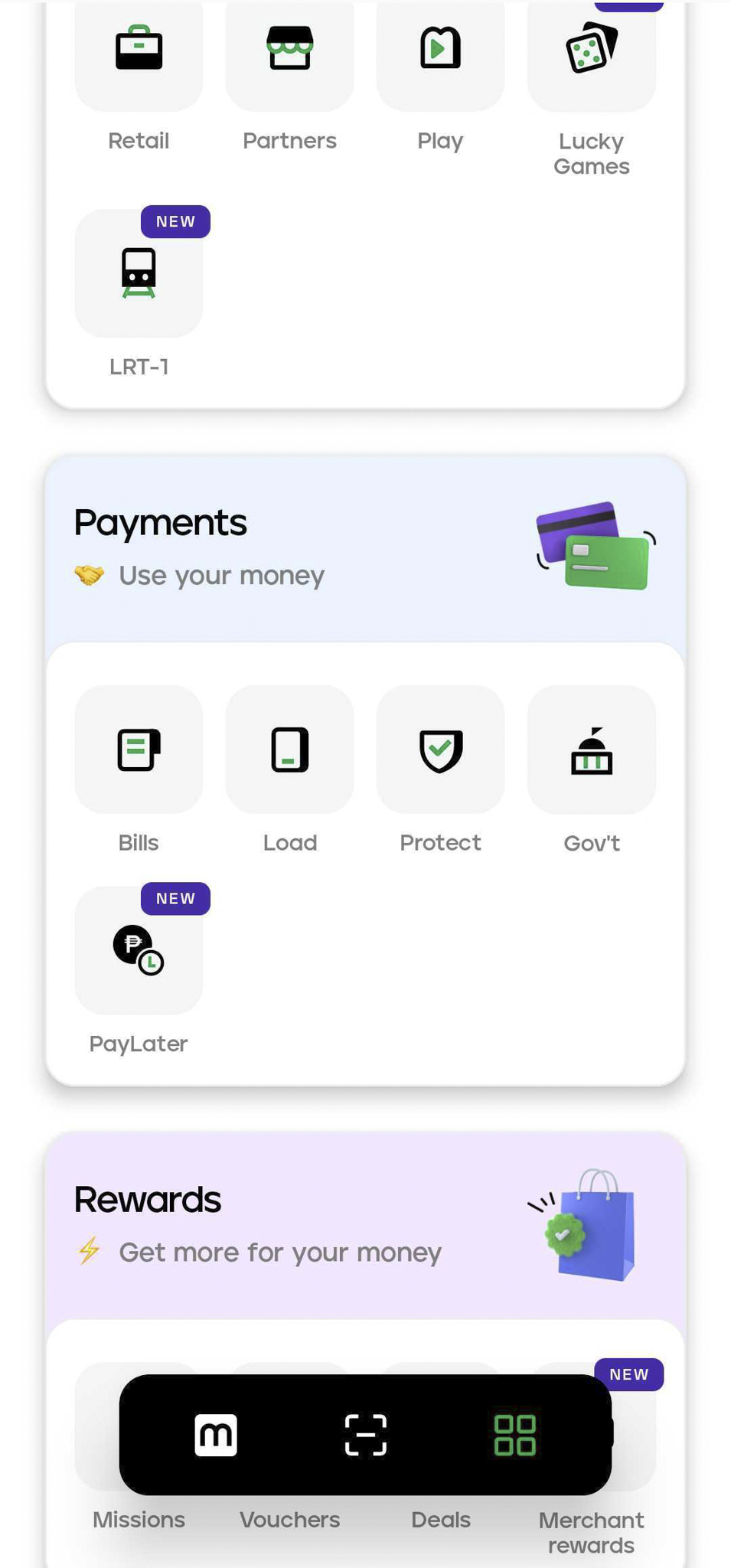

- Go to the Maya app. Tap More>Payments Section, then Gov’t, and select BIR from the government options.

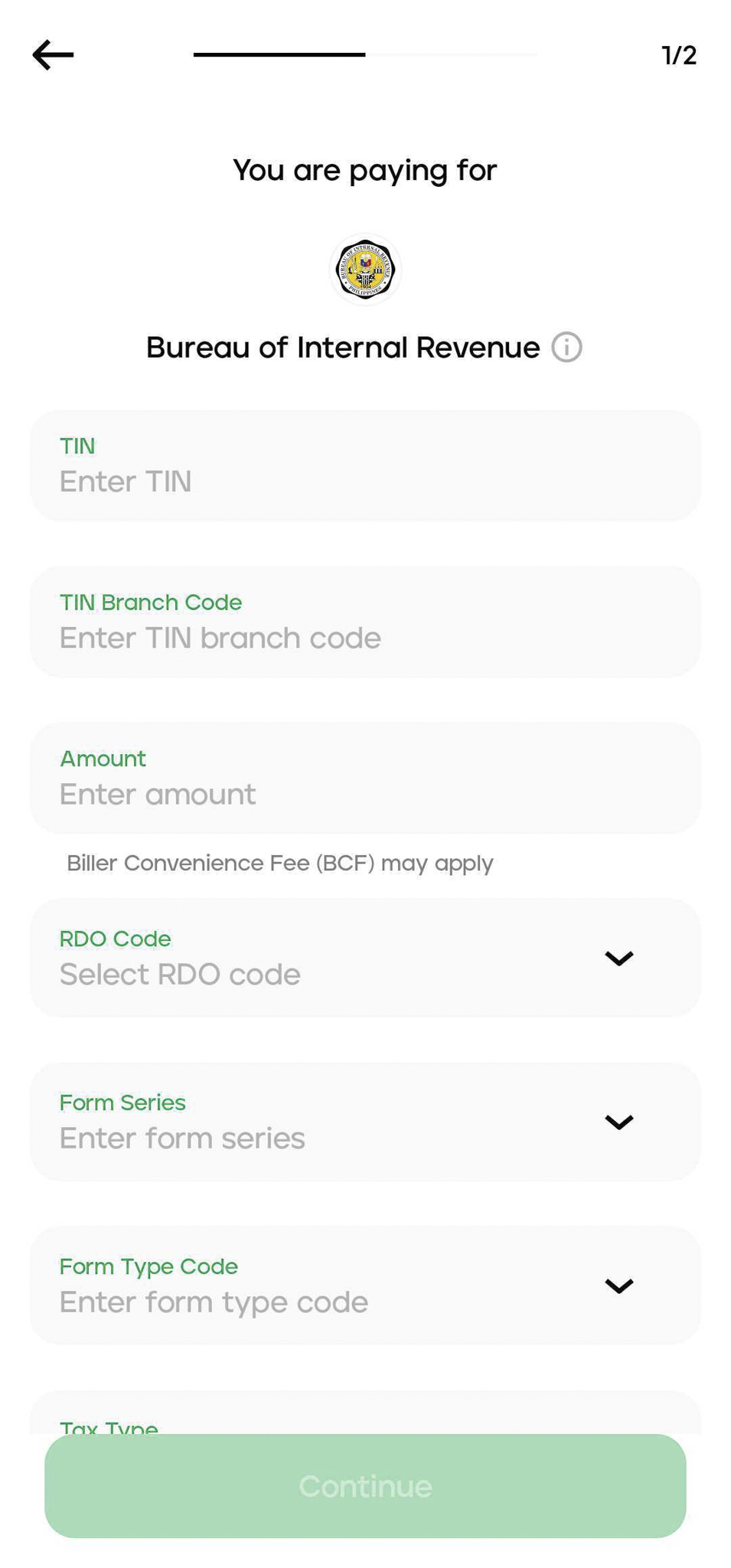

- Input your Tax payment details. Just like with the BPI eGov method, make sure to input the same information you added to the filled-up form 2551M/Q that you submitted online to BIR.

- Click Proceed with Payment to Verify details.

- Confirm payment with receipt details. Maya will automatically generate a receipt for your tax payment, and the breakdown will include the Php 20 transaction fee. If you included your email, you should receive an email confirmation as well.

Which is the better option?

If you’re after lower transaction fees, BPI’s eGov is better since there are no transaction fees involved. However, this method redirects you to Landbank’s payment platform, which may add confusion to some users. The only advantage of this method is that other banks like Landbank, Asia United Bank, PSBank, RCBC, Robinsons Bank, and Union Bank support this method as well.

Maya, on the other hand, will need you to cash-in your account, though there are methods that you can cash in without any additional fees. While Maya has a Php 20 transaction fee, the payment process is much faster compared to BPI’s method.