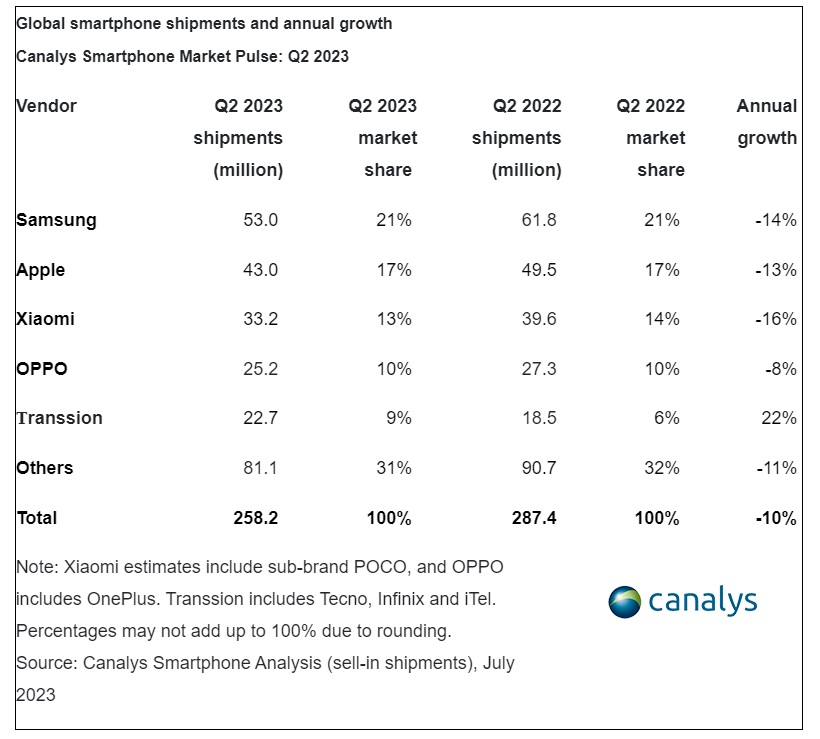

Looks like Transsion, the mother company of iTEL, TECNO, and Infinix has had a great quarter, as Canalys said that they’ve managed to get into the top 5 of worldwide shipments for smartphones for Q2 2023, a first for the company.

Transsion managed to ship 22.7 million devices in Q2 of 2023, which is up from 22% YOY which allowed them to net 9% of the worldwide smartphone market share by shipments.

Interestingly of the 5 brands in the list, namely top dog Samsung, Apple, Xiaomi, and OPPO, Transsion was the only one that posted positive growth in terms of units shipped. The post-pandemic period has been rough on smartphone manufacturers, as demand has dropped thanks to a dampening of overall consumer demand, rising inflation, and economic uncertainties as the world opens up again.

Samsung remains the top player in terms of the number of phones shipped worldwide for Q2 of 2023, delivering around 53 million units, with their market share remaining unchanged at 21%. Apple is running close behind, which managed to ship 43 million units worldwide. Their overall market share remains unchanged from last quarter at 17%.

Xiaomi sits in third place, shipping 33.2 million units in Q2 2023, with their market share falling slightly to 13% from 14% during the same time last year. OPPO shipped 25.2 million units in the same period to close out the 4th spot, which saw its market share unchanged from last year.

According to Canalys, the worldwide smartphone market fell by 10% to 258.2 million units in Q2 2023, showing a slowdown in decline. “The decline in the global smartphone market has once again narrowed, helped by an industry-wide inventory reduction and signs of demand recovery in certain regional markets,” commented Amber Liu, Analyst at Canalys.

“Transsion has rapidly captured the pent-up low-end demand in the Middle East and African markets where the stabilizing foreign exchange also supported channel partner confidence. Additionally, its expansion in Latin America in the past few quarters has allowed the vendor to capture low-end demand in some under-penetrated markets,” she adds.